Harm reduction group as an investment

INVESTMENT PROFILE @SPARGURUN JUST CAME OUT WITH ONE ANALYSIS OF ITS INVESTMENT IN HARM REDUCTION GROUP

CASE:

- Structural growth - better alternative to tobacco

- Distribution agreement with DAGAB

- Increased sales

- Geographic expansion

- The market can reach 2 MDR by 2025

RISKS:

- Will they reach profitability in 2024

- Balance sheet

- Increased competition? More people who want to share the cake?

SALE

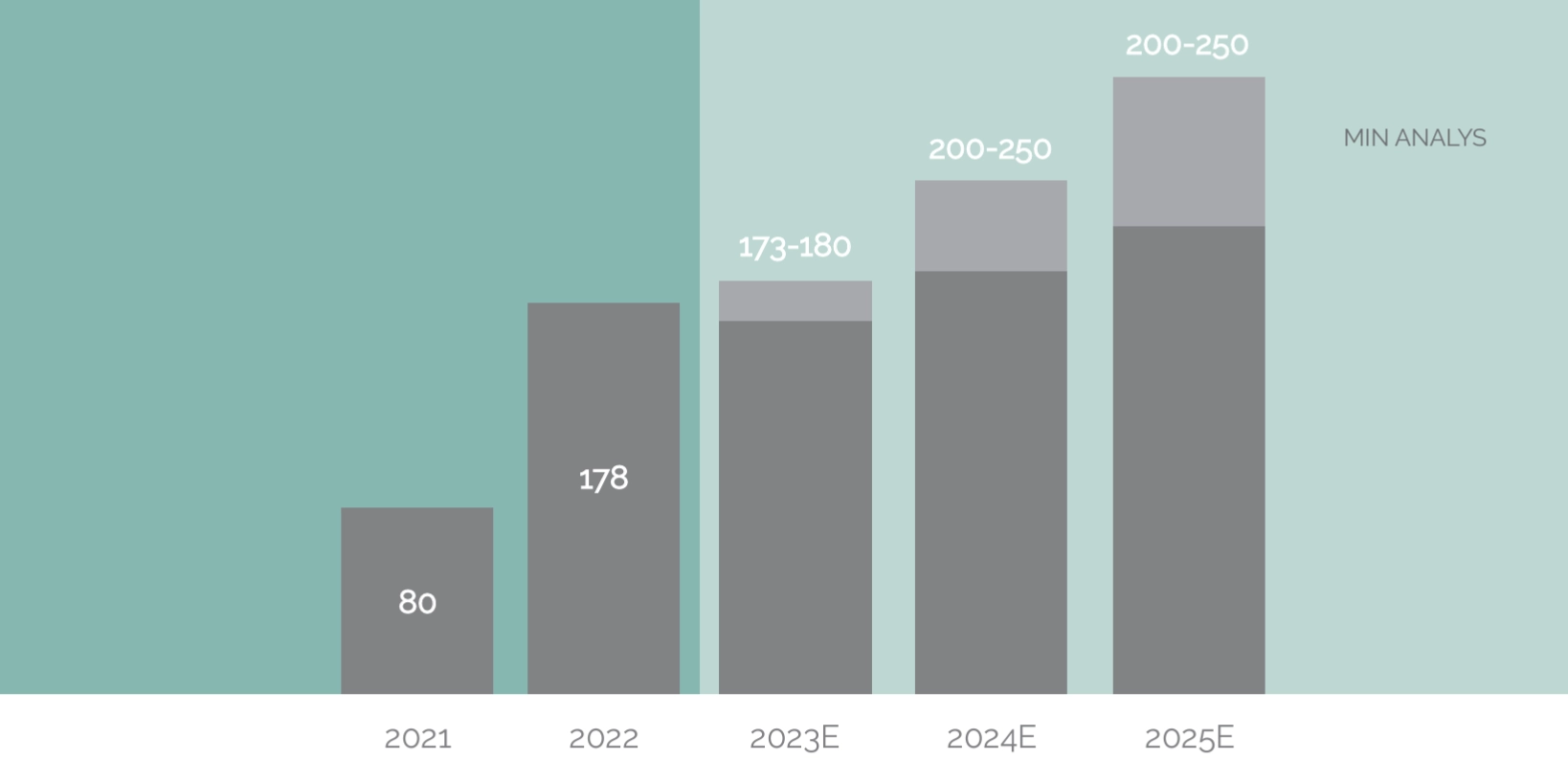

My assumption is that you can reasonably maintain your market share.

Today very difficult to assess how much the market will grow.

PROFITABILITY AND VALUATION

Harm Reduction Group is currently making a loss. Here I therefore want to make an assessment of how the costs will increase in line with the structural growth in the industry and how economies of scale can thereby be achieved. According to CEO Marius Arnesen, the company currently has a cost suit that is suitable for growth. But taking my turnover assessment for 2025 and the above into account, I have calculated two potential scenarios to come up with a possible range.

Great uncertainty here, but an approach.

There is clearly potential for today's share price

of SEK 0.215 is a very low valuation for this

falling out.

| REVENUE | 300 | 240 |

| RAW MATERIALS | -150 | -120 |

| GROSS PROFIT | 150 | 120 |

| EXTERNAL COSTS | -55 | -48 |

| STAFF COSTS | -55 | -48 |

| DEPRECIATIONS | -20 | -19 |

| EBIT | 20 | 5 |

| NET FINANCE | -3 | -3 |

| TAX | -3 | 0 |

| PROFIT | 14 | 2 |

| EV/EBIT | 4 | 17 |

| P/E | 6 | 40 |

MY POSITION - SPARGURUN

Harm Reduction Group is a smaller growth company with

a market cap of SEK 50 million. One has not yet shown

bottom line profitability. Of course it is worth it

point out that the risk in this case is high.

Normally, this company is still in an early stage

my usual strategy. Emn after conversation with bland

other CEO Marius Arnesen, I got a positive impression of

the company and above all their future ambitions which

are backed by a very interesting structural

trend.

For that reason, I have made a small investment in the Harm Reduction Group

"HARM REDUCTION SUCCEEDS IN STRENGTHENING ITS MARGINS

AND KEEP ITS CURRENT MARKET SHARE CAN

THE OUTCOME WAS VERY GOOD

SHORT SUMMARY

Harm Reduction Group is a company with clear structural growth behind it, which provides a great potential to increase sales significantly from current levels. Economies of scale should be able to be extracted, which can affect the margin, which is currently at a level that is not sufficient.

Personally classify it as a high-risk case. But if they manage to strengthen margins and maintain their But if they succeed in strengthening margins and maintain their current market share, the outcome could be very current market share, the outcome could be very good. Good.

In a few days, @spargurun will release his entire analysis and a more in-depth interview with Marius Arnesen CEO on his social media channels.

Harm Reduction Group shares are listed on the Spotlight Stock Market under the short name NOHARM and are traded via banks and stock brokers. Click here to read more about Harm Reduction's share.

ANDREAS ERIKSSON CFO, TELLS BRIEFLY ABOUT WHY

HE THINKS YOU SHOULD INVEST IN THE HARM REDUCTION GROUP

SHORT INTERVIEW WITH STOCK ANALYST SEBASTIAN ANDERSSON ABOUT HOW

THE HARM REDUCTION MARKET WILL DEVELOP

We called Sebastian Andersson who is a stock analyst at Redeye to hear what he thinks about the future of e-cigarettes and how the market will develop.

How do you see the future of e-cigarettes in Sweden in the next 2-3 years? 2-3 years?

It is clear that the market will continue to expand annually. Both large and small players in the global nicotine market have directed their interest towards e-cigarettes, both for smoking cessation and to increase their market shares. With regard to the Swedish market, we predict sales of approximately SEK 500 million in 2023. We expect that demand will increase in the retail sector in the future, and that the market will amount to approximately SEK 2 billion in 2025.

Now that competition is increasing in this industry, what will be the most important competitive advantages?

We believe that a wide distribution network together with quality products creates demand for both the stores that sell e-cigarettes and the consumer who buys. To get into different distribution channels, you need a good selection, and to sell once you are in, you need good quality products. As e-cigarettes are a relatively young and new product, the quality has varied greatly since its launch. We believe that will change, where those who bet and invest in product quality will stand as winners in the coming years.

What are the most important strategic goals for a company in e-cigarettes in the short or long term?

In the short term, I think you have to get into different distribution channels with either your own products or resell other people's. If you build up a large network and maintain the relationship over time, you should gain volume-wise economies of scale compared to competitors, which contributes to better margins and a stronger positioning for the long-term strategy. In the long term, I believe in product development of self-produced products within the segment to be able to develop its profitability. The companies that can develop product advantages in the form of flavorings, design, and technical innovations should have advantages in the market both in terms of demand and in terms of margins.

What does the e-cigarette market look like in the rest of the world?

Today, over a billion people smoke traditional cigarettes. But even now the global e-cigarette market is valued at USD 22.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% until 2027. If you do a quick trend scan, you will see an increased understanding of e-cigarettes as a safer alternative to traditional cigarettes, while the growing market is driven by increased popularity among the younger population. In Europe, the UK is the largest market, where traditional tobacco countries such as Germany, Spain and Italy also hold large parts of the market.

How do you see Harm Reduction Group's growth in the coming years?

Today, Harm Reduction Group has approximately 27% of the e-cigarette market in Sweden. We believe that the larger tobacco companies will contribute with increased competition, something that we already see today, but that Harm Reduction Group has good opportunities to maintain its market share in the coming years. Mainly because of its positioning in retail.

Which players do you think will fight for the e-cigarette market?

Already now, we see the larger companies in the tobacco industry positioning themselves strongly in e-cigarettes. BAT has begun its sales journey in Sweden and we also believe that Philip Morris will be a major player in Sweden going forward. Of the Swedish companies, we see Harm Reduction Group, Eciggkedjan and Vont as three companies that were early on the market and that have seen the advantages and growth opportunities of nicotine, instead of tobacco.

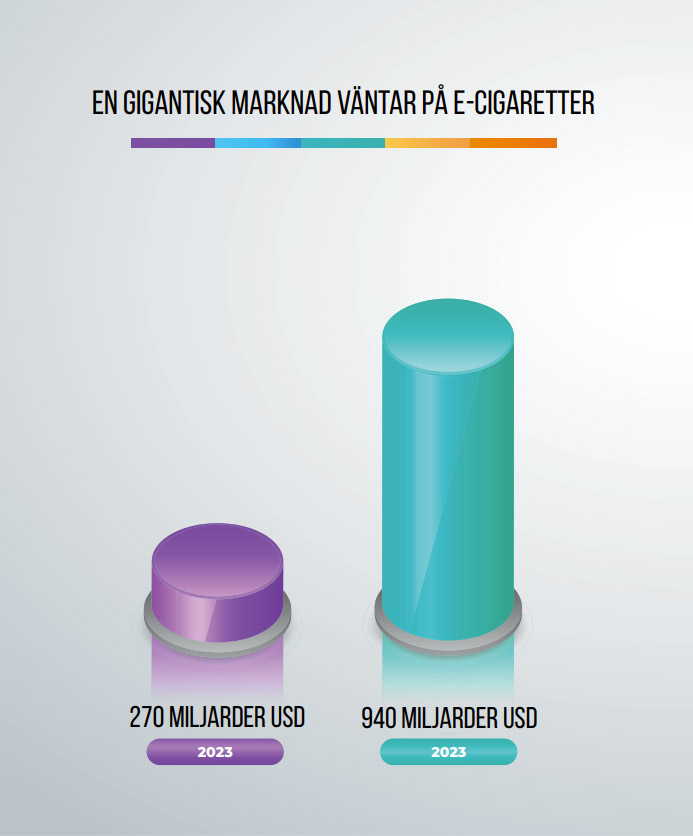

The total turnover of tobacco products in Europe in 2023 is estimated at USD 270 billion. Looking at the global market as a whole, tobacco products will be sold for an estimated USD 940 billion in 2023. This turnover is expected to increase in the coming years – with vaping and snus taking up more and more of the pie

LARGE RANGE AND GREAT OPPORTUNITIES

Our vision is a tobacco-free world. In order to satisfy the many wishes and needs of today's smokers, we offer a wide and constantly growing range of tobacco-free products in several different categories, with different price pictures. A great challenge, but also gigantic potential as there are estimated to be over a billion smokers today.

THE NORDIC IS JUST THE BEGINNING - GREAT BRITAIN NEXT

Our next market is the UK - the world's second largest vape market - this year will be worth around £1.2bn and is expected to reach £1.4bn in the coming years

the three years. The British health authorities (British Health) have decided that vaping is their preferred tool towards the goal of achieving a smoke-free society by 2030.

INVEST IN A SMOKE-FREE FUTURE TODAY

Harm Reduction Group is the Nordic region's fastest growing company in the smoke-free segment and a strong player in the major change currently underway. The company is listed on the Spotlight Market under the name Harm Reduction Group (NOHARM) - and is the only company available to invest in that works with this as a core business.

Here you get more information about our share price and can trade the share